Raxis Strike: Penetration Testing

Penetration Testing for Unparalleled Security

Tailored, Thorough, Trusted Penetration Testing

Raxis Strike represents the pinnacle of Traditional Penetration Testing, offering a collaborative and tailored approach to cybersecurity that evolves with your threat landscape. Looking for something with unlimited penetration testing? Check out Raxis Attack.

Real Exploitation

By leveraging actual hacker-created exploits and techniques, we offer invaluable insights into potential attack vectors and their impact, enabling you to fortify your defenses against real-world threats effectively.

Pivot and Escalate

The Raxis storyboard meticulously details how our penetration testing experts simulate sophisticated insider threats, demonstrating the potential path of system compromise and privilege escalation.

The Power of Team

The Raxis team of expert penetration testers frequently work together to combine their diverse skills and expertise to evaluate any technology or software, delivering optimal security testing for your unique infrastructure.

Industry Specific

Industry-specific expertise allows the Raxis team of penetration testers to efficiently target sector-unique vulnerabilities and compliance needs, ensuring more effective security assessments.

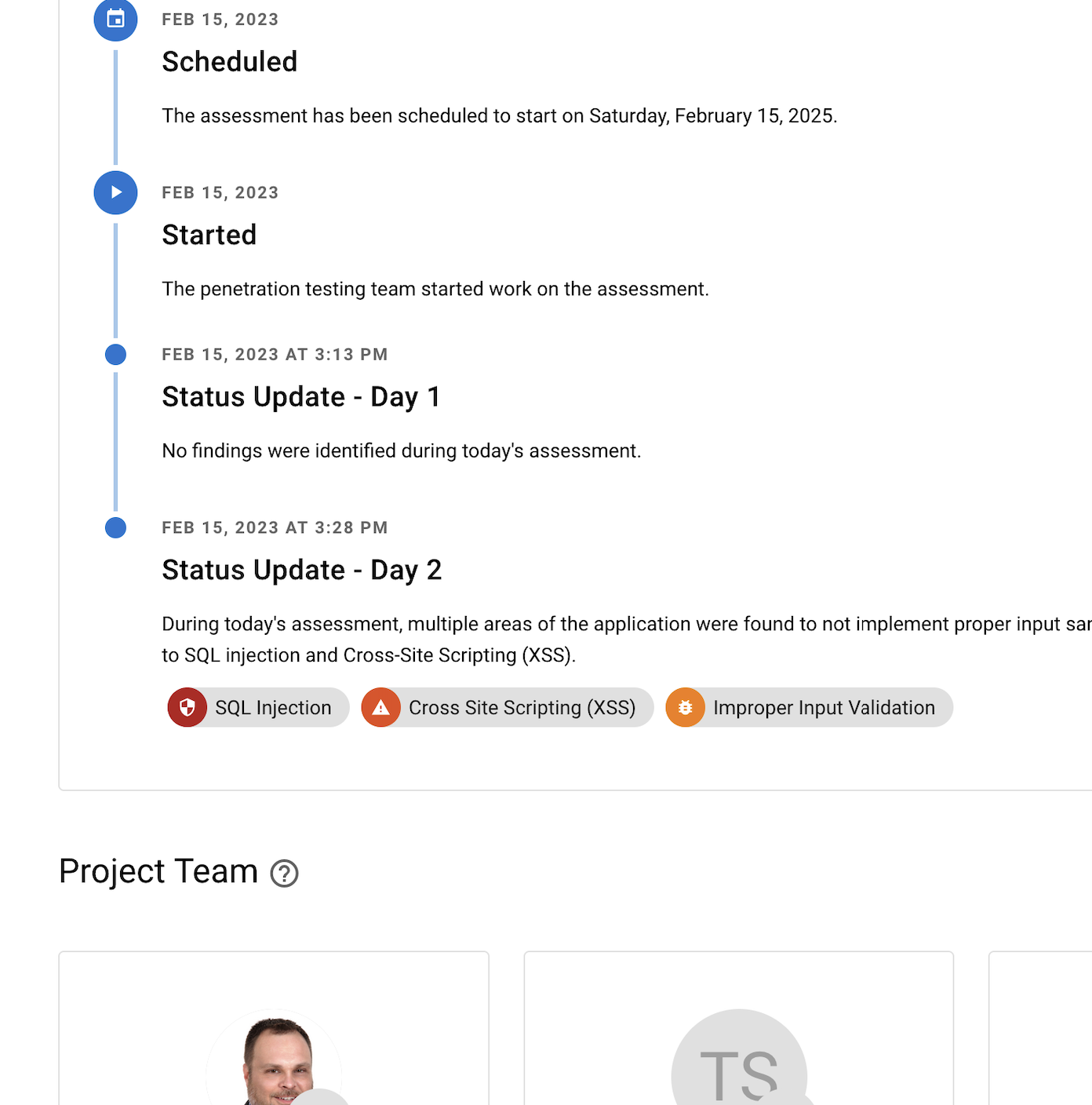

See the Attack as It Happens

Managed through Raxis One, our specialists collaborate to employ real-world hacker tools and techniques, identifying and exploiting system vulnerabilities to provide actionable insights that fortify your cybersecurity posture. Looking for PTaaS? Check out Raxis Attack.

Key Features of Raxis Strike

Raxis Strike, our traditional penetration testing service, provides the insights you need to make informed decisions about your cybersecurity strategy.

Collaborative Penetration Testing Engineers

Our expert team collaborates internally and with you to combine skills as needed to simulate sophisticated cyber attacks, tailoring our approach to effectively assess diverse technologies. This comprehensive approach delivers invaluable, actionable intelligence to strengthen your security posture.

Customized Testing Scenarios

Every organization faces unique security challenges. Our penetration tests are tailored to your specific digital environment and industry, ensuring relevance and maximum effectiveness.

Data Exfiltration Demonstration

Unlike many competitors, we include this crucial step to showcase the real risks stemming from cybersecurity vulnerabilities. Not only is this the fun part of our jobs, but also it drives improvements to cybersecurity budgets.

Compliance Support

Raxis Penetration Tests fulfill various compliance mandates, ensuring you meet or exceed regulatory requirements. Raxis routinely performs Penetration Testing for NIST 800-171/CMMC, PCI, HIPAA, GLBA, ISO 27001, and SOX.

Cybersecurity Meltdown Averted

Raxis Hack Stories

Our stories are based on real events encountered by Raxis engineers; however, some details have been altered or omitted to protect our customers’ identities.

In the high-stakes world of cybersecurity, the Raxis Strike Team uncovered a chilling vulnerability that sent shockwaves through the industry. During a routine assessment, our team stumbled upon an embedded device controlling a nuclear reactor—a discovery that made their hearts race. But what truly alarmed them was not just the device’s critical function but its startlingly lax security.

The device was accessible via telnet, an outdated and notoriously insecure protocol. Even more alarming, it was protected by nothing more than default credentials—a digital equivalent of leaving the keys in the ignition of a nuclear-powered vehicle.

Recognizing the gravity of the situation, Raxis experts immediately alerted the client, demonstrating not just technical prowess but also a deep commitment to responsible disclosure and client safety. This incident serves as a stark reminder that, in the complex landscape of modern networks, even the most critical systems can harbor overlooked vulnerabilities. Raxis’ ability to identify and address such high-stakes issues showcases why our penetration testing services are crucial for organizations seeking to fortify their defenses against potential catastrophic breaches.

Why Choose Raxis?

- Certified Cybersecurity Experts: Our team holds elite certifications, including Offensive Security Certified Professional (OSCP), Offensive Security Certified Expert (OSCE), Certified Information Systems Security Professional (CISSP), and Certified Information Security Manager (CISM), ensuring unparalleled expertise in penetration testing and ethical hacking.

- Recognized by Gartner: Raxis was named a Sample Vendor for Penetration Testing as a Service (PTaaS) in Gartner’s 2024 Hype Cycle reports for Security Operations and Application Security, affirming our leadership in delivering innovative, continuous cybersecurity assessments.

- Featured on Fox 5 Atlanta: Frequently highlighted on Fox 5 Atlanta for our cybersecurity insights, Raxis is a trusted voice in protecting organizations from evolving threats.

- Experienced U.S.-Based Team: Our U.S.-based ethical hackers, averaging over 15 years of cybersecurity experience, deliver tailored, collaborative testing to strengthen your defenses.

Raxis Strike is Traditional Penetration Testing

F.A.Q.

Frequently Asked Questions

What is Raxis Strike?

How does Raxis Strike differ from automated vulnerability scans?

What types of systems can Raxis Strike test?

How long does a Raxis Strike penetration test take?

What does the Raxis Strike process involve?

How does Raxis ensure the safety of my systems during testing?

What kind of report will I receive after a Raxis Strike assessment?

Does Raxis Strike include retesting after vulnerabilities are addressed?

Yes, Raxis can include a retest to validate remediation efforts, which is often required for compliance purposes.