Financial and Banking

Penetration Testing Tailored for the Financial Services Sector

Protecting Financial Systems, Safeguarding Data, and Ensuring Compliance

The financial sector is one of the most targeted industries for cyberattacks, with hackers seeking to exploit sensitive data, customer information, and financial systems. Raxis specializes in penetration testing tailored for banks, credit unions, investment firms, and other financial institutions. Our expert-led services help you identify vulnerabilities, protect critical assets, and maintain compliance with industry regulations—all while ensuring the trust of your customers.

In 2023, the finance industry accounted for 27% of all breaches, making it the most breached sector globally, surpassing even healthcare. Cyber incidents in the financial industry surged to 3,348 reported cases worldwide in 2023, nearly doubling from the previous year. These alarming statistics highlight the urgent need for robust cybersecurity measures, including penetration testing tailored to financial institutions.

Segmentation Testing

In the financial and banking sector, segmentation testing is essential to ensure that sensitive systems, such as those handling payment processing or customer data, are properly isolated from broader networks. Without effective segmentation, attackers can exploit vulnerabilities in less secure systems to gain lateral access to critical assets within your Cardholder Data Environment (CDE) or other high-value areas.

Segmentation testing validates that your network boundaries are configured correctly, ensuring compliance with standards like PCI DSS while reducing the scope of audits and minimizing risk exposure. By identifying misconfigurations, gaps in firewalls, or improper access controls, Raxis helps financial institutions prevent unauthorized access and maintain a strong security posture. This process not only enhances regulatory compliance but also protects sensitive customer data and ensures uninterrupted service delivery in an increasingly interconnected digital landscape.

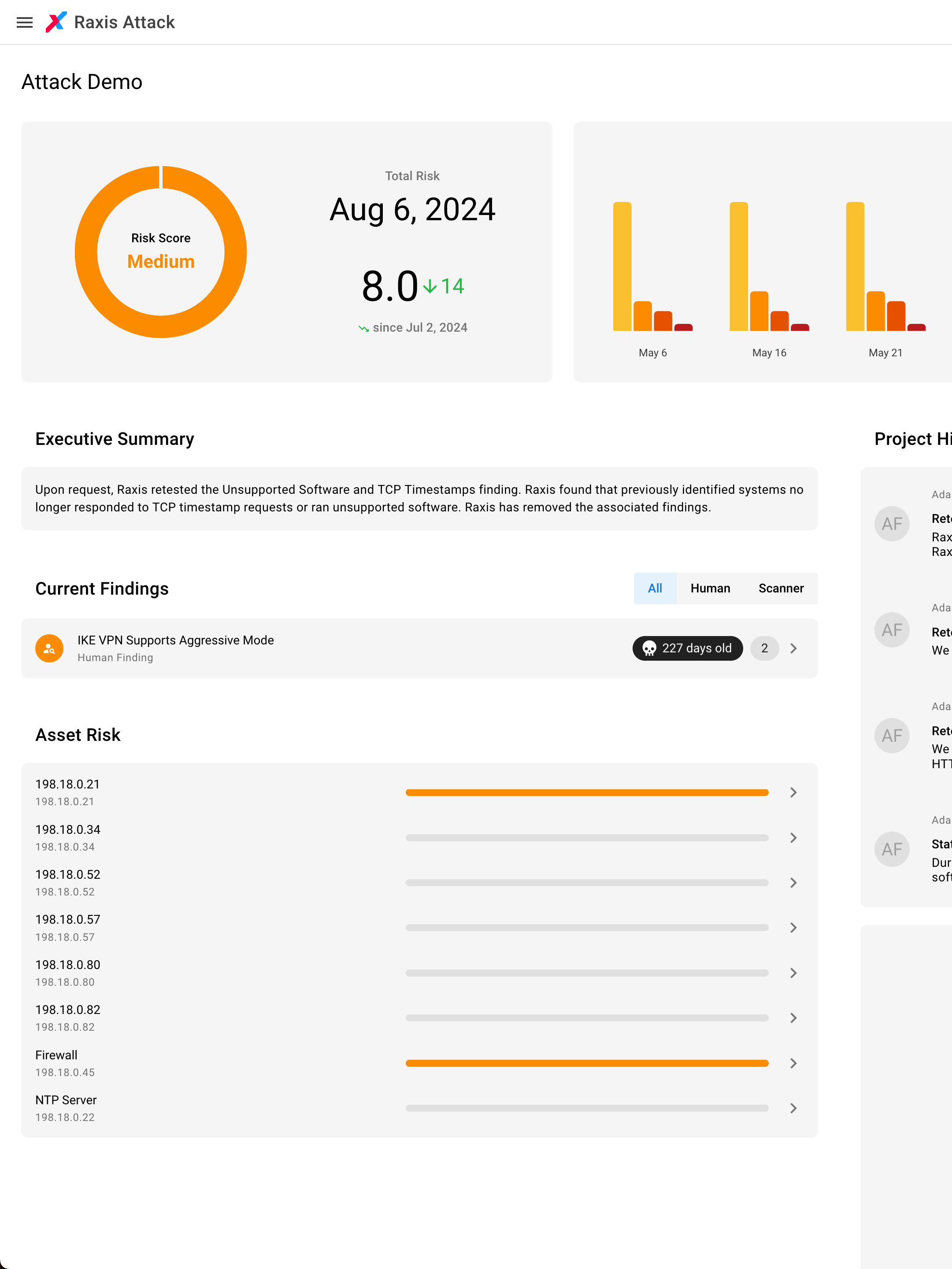

Re-test for Validation

Cybercriminals constantly evolve their tactics, and even the smallest misconfiguration or incomplete fix can leave your institution exposed. Retesting validates that your remediation efforts have successfully mitigated the identified risks while ensuring no new vulnerabilities were introduced during the process.

By revisiting the findings from the initial test, Raxis uses the same tools and techniques to confirm that fixes are implemented correctly, whether at the application, network, or system level. This step is particularly important for financial institutions to maintain compliance with regulations like PCI DSS and FFIEC guidelines, as it demonstrates a commitment to ongoing security improvement. Beyond compliance, retesting provides peace of mind by verifying that critical systems are secure and resilient against real-world threats, reinforcing customer trust and safeguarding sensitive financial data.

Compliance Approved Reporting

Imagine a cybercriminal targeting your financial institution. They aren’t relying on basic tools or surface-level scans—they’re using creativity, persistence, and advanced techniques to find weaknesses in your defenses. Now ask yourself: would an automated scan alone be enough to stop them?

Raxis knows the answer is no. That’s why we take a hands-on approach to penetration testing that goes far beyond what automated tools can deliver. While many competitors rely solely on scans to identify theoretical vulnerabilities, we dig deeper, uncovering the real-world risks that could jeopardize your financial systems.

Cybercriminals don’t use automated tools—they use imagination together with sophisticated methods and persistent tenacity to breach financial systems. At Raxis, we do the same. Following the NIST SP 800-115, we go beyond basic scans to provide proof-of-concept exploits that reveal exactly how attackers could compromise your systems. We don’t just identify vulnerabilities; we demonstrate their real-world impact. By simulating sophisticated attack scenarios, we uncover hidden risks that automated tools miss, helping you build a more resilient defense against evolving cyber threats.

Customized Testing Scenarios

Raxis delivers tailored penetration testing solutions that address the unique security challenges financial institutions face, ensuring comprehensive compliance and robust network segmentation through expert-driven assessments designed to protect sensitive data and meet regulatory requirements.

Compliance Requirements

Financial and banking institutions must adhere to a range of compliance requirements, including PCI DSS for payment security, AML/BSA laws for anti-money laundering and suspicious activity reporting, GDPR for data protection, GLBA for safeguarding customer privacy, and frameworks like NYDFS Cybersecurity Regulation to implement robust cybersecurity policies and controls.

Pivot and Escalate

Pivoting and escalating privileges are critical in financial and banking penetration testing because they simulate real-world attack scenarios, demonstrating how an attacker could move laterally within a network, gain access to sensitive systems, and exploit vulnerabilities to compromise critical assets like customer data or payment systems, ultimately helping organizations understand and mitigate these risks.

Audit Approved Methodology

Unlike competitors who rely solely on automated scans, our approach remains compliant, as we provide proof-of-concept exploits and follow the NIST SP 800-115.

Raxis Attack: PTaaS for Financial and Banking Institutions

Tailored for Financial Institutions

Continuous Protection Against Evolving Threats

With cybercriminals constantly innovating their tactics, financial institutions need more than annual penetration tests. Raxis Attack provides ongoing assessments to ensure your defenses remain effective against emerging threats.

Simplified Compliance Management

Whether you’re preparing for a PCI audit or meeting GLBA requirements, Raxis Attack streamlines compliance by continuously validating your security controls and providing audit-ready documentation.

Direct Access to Experts

One Simple Misstep

Raxis Hack Stories

All stories are based on real events encountered by Raxis engineers; however, some details have been altered to protect our customers’ identities.

Our customer, a security-minded regional bank that had performed annual penetration tests for years, was confident that they had crossed all their t’s and dotted all their i’s in remediating previous tests. But, with a lot of employees, critical projects, and moving parts, they understood that frequent pentesting was critical. The Raxis Strike Team examined the internal network remotely using Raxis Transporter and found that many common points of entry — from default system credentials to broadcast relay attacks — achieved no useful results. Relentlessly scrutinizing the network for anything questionable or unusual, the team discovered what appeared to be a large file share labeled as a backup.

Taking a closer look, our team discovered that the file share housed a recent backup of a large shared company file structure. They split up the directories looking for useful files. The team first discovered sensitive HR files that listed employee PII such as SSNs, names, and addresses. Next they found sensitive communications that included customer PII and financial data. And finally, our team discovered an innocuous-looking Excel file buried deep within an IT employee’s personal share.

Intrigued, our team bypassed the simple encryption on the password-protected file. To their surprise, the file contained a goldmine of information – a meticulously maintained list of internal system passwords, including those for critical banking applications. It seemed an overzealous IT administrator had created this file as a personal reference, unwittingly introducing a severe security vulnerability.

With newfound access, our team methodically worked their way through the bank’s internal systems, documenting vulnerabilities and potential attack vectors along the way. The forgotten open file share backup proved to be the key that unlocked the entire network, allowing Raxis to demonstrate the real-world risks the bank faced.

F.A.Q.

Frequently Asked Questions